AI Sentiment: Cautiously Bullish

Reason: Fastenal is expected to meet Q4 forecasts with a predicted increase in earnings per share, despite ongoing challenges from the US-China trade war. The company's investments and strong fundamentals are expected to support continued success.

Leading industrial supply company, Fastenal, is expected to report its fourth quarter earnings for the year on January 17. Market experts predict that the results should meet the expectations set for the period, continuing the company's track record of robust performance. Forecasts suggest that the earnings per share (EPS) will likely be $0.37, an increase from the $0.31 reported in the same quarter of the previous year. However, there are concerns that the ongoing trade war may negatively impact the overall performance.

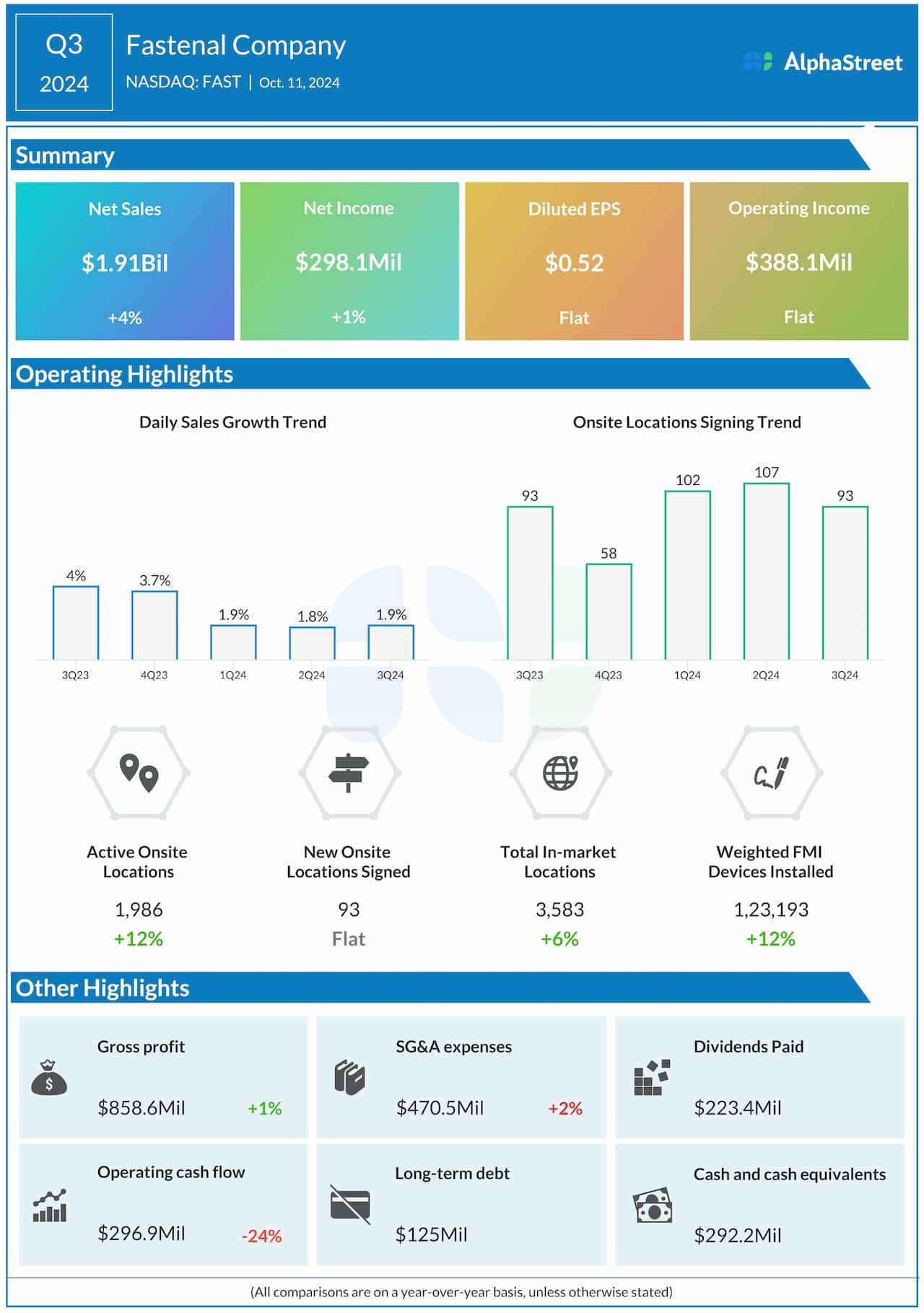

In the third quarter, Fastenal exceeded market predictions with its strong performance, driven by higher demand for industrial vending products and Onsite locations. Its sales increased by 13% year-over-year to reach $1.28 billion, while the EPS grew by 38%. Despite this, the company's shares have been under pressure since October, largely due to the ongoing trade war between the United States and China and the resultant uncertainty in the market.

The company, which is a major player in the industrial and construction supplies sector, has been investing heavily in its Onsite locations and industrial vending machines. These investments have been paying off, with both segments showing strong growth and becoming significant contributors to the company's sales performance.

However, the trade war continues to cast a shadow over the proceedings. The tariffs imposed by both countries have increased the cost of goods, which could potentially affect Fastenal's margins. The company has stated that it is working to mitigate the effects of the trade war by passing some of the increased costs on to its customers and by finding alternative sources for its products.

Despite these challenges, Fastenal's solid fundamentals and strong growth prospects are expected to help the company maintain its momentum. The company's focus on growth through investment in its Onsite locations and industrial vending machines, coupled with its efforts to mitigate the effects of the trade war, are likely to ensure its continued success in the market.