AI Sentiment: Bullish

Reason: Despite industry challenges such as supply chain disruptions and increasing raw material costs, KB Home is expected to report a significant increase in earnings and revenue for Q4 2024 due to the booming housing market and effective cost management strategies.

Next week, the leading homebuilding company, KB Home (KBH), is expected to announce its earnings results for the fourth quarter of 2024. The company has a reputation for frequently surpassing market expectations, and this time around, analysts anticipate an upbeat performance.

The financial performance of KB Home is closely tied to the housing market's overall health. The recent record-low mortgage rates and the shift towards suburban living, brought about by the pandemic, have fueled a boom in the housing market. Consequently, this has created a favorable environment for homebuilders like KB Home.

However, it's worth noting that the industry is experiencing some challenges. Supply chain disruptions, labor shortages, and increasing raw material costs are among the issues currently affecting homebuilders. Despite these obstacles, KB Home's wide geographic footprint and robust backlog, coupled with its effective cost management strategies, have helped the company maintain a steady performance.

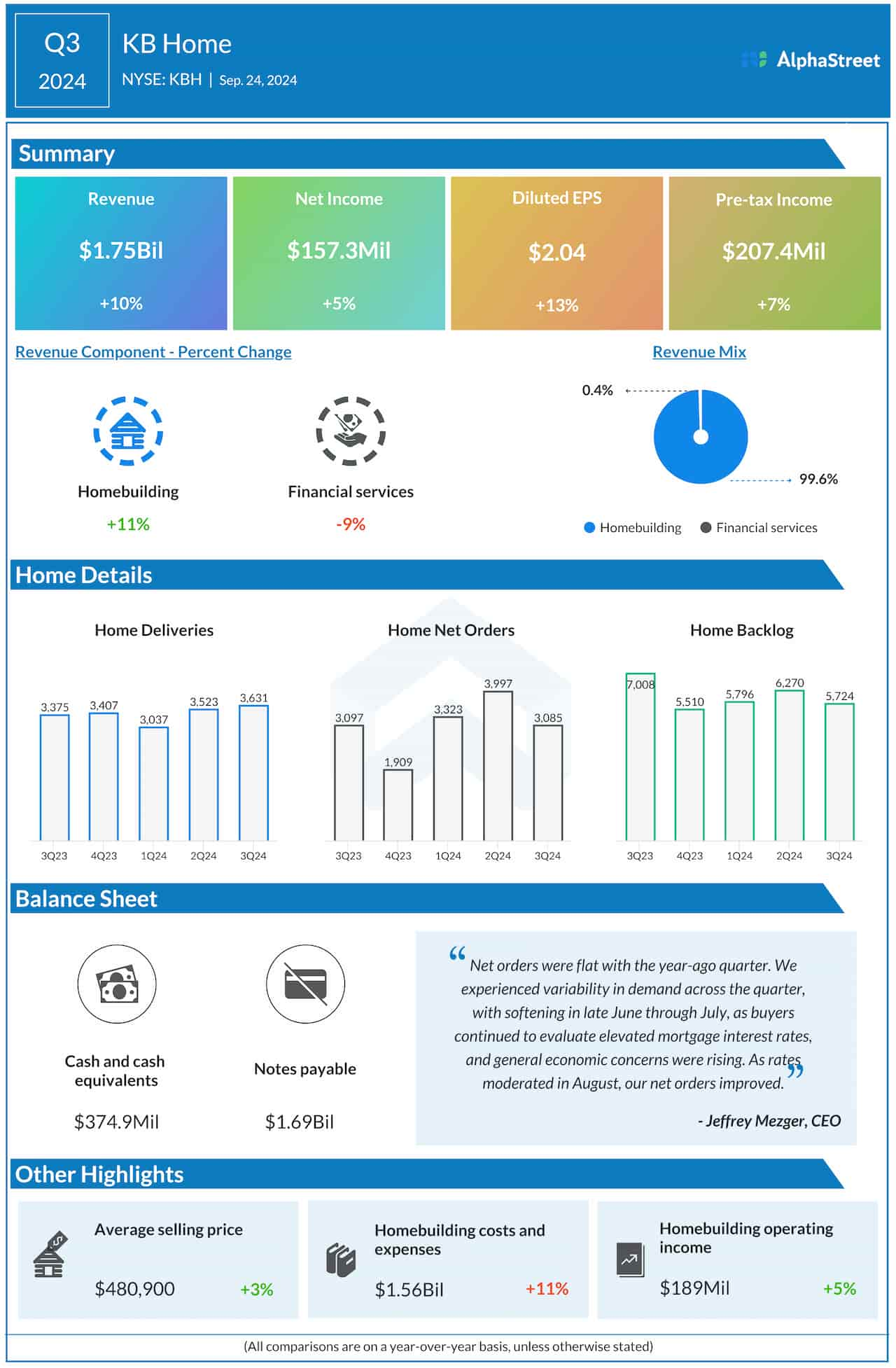

For the fourth quarter, Wall Street expects KB Home to report earnings of $1.69 per share, which would represent a significant increase from the same period last year. Revenue is also expected to see a considerable uptick year-over-year. While the company's shares have underperformed the industry over the past year, the anticipated strong Q4 results could provide a much-needed boost.

The company's CEO, Jeffrey Mezger, has expressed confidence in the demand trends for new homes, citing the company's strong order trends and higher selling prices. Also, KB Home's focus on first-time and first move-up buyers, a category that has shown resilience even in challenging market conditions, adds to the company's strengths.

Therefore, while KB Home faces certain industry-wide challenges, its strategic positioning and strong demand trends make it a company to watch in the upcoming earnings season. The forthcoming financial report could offer valuable insights into the state of the housing market and the broader economy.